How compounding accelerates your investment growth

New to investing? One of the most important concepts to understand is compounding returns. It’s a simple yet powerful process that helps grow wealth over time, turning even small contributions into sizeable savings – with patience and consistency.

Here’s how compounding is a long-term investor’s best friend.

What is compounding?

Put simply, compounding is the process where your investment returns are reinvested to generate even more returns over time.

Think of it like a snowball effect. Reinvested returns build on themselves, gradually adding up and creating exponential growth.

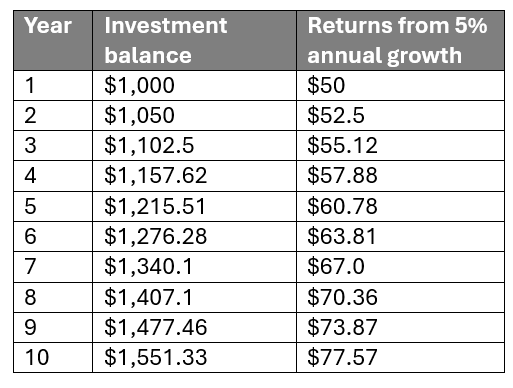

For example, say you invest $1,000 with an annual return of 5%. After one year, your investment earns $50, bringing your balance to $1,050. In the second year, that $1,050 now earns 5%, or $52.50, resulting in a new balance of $1,102.50. Each year, your returns grow slightly faster because you’re earning returns on both your original investment and the returns you’ve already made.

The table below provides a year-by-year breakdown. In this scenario, you have contributed only the initial $1,000. All the growth here is from compounding.

The earlier you start, the better

The key to compounding is time. The earlier you start investing, the more time your returns have to build upon each other. Even small contributions can lead to impressive growth over the years.

Imagine you start investing $50 a month ($600 per year) with an average annual return of 6%. After 10 years, you would have contributed $6,000, but thanks to compounding, your investment could grow to around $8,383.

What if you started 20 years ago, instead? Your investment could have grown to around $23,395 – almost three times $8,383 in only twice the time.

How to make the most of compounding

Ready to start your compounding journey? Here are a few tips to make the most of it:

- Start with regular contributions

You don’t need a lot of money to begin. Small, regular contributions work well with compounding because they add up over time and help your investments grow steadily. If you can, set up automatic contributions to stay consistent without thinking about it.

- Think long-term

Compounding works best when you keep a long-term perspective. It can be tempting to withdraw earnings early, especially if your balance is growing, but patience pays off. The longer you let your investments grow, the more compounding will work in your favour, building your wealth over time.

- Avoid timing the market

With investing, it’s not about timing in the market, but time in the market. Compounding is a strategy that works regardless of market ups and downs. The goal is to stay invested, even when markets fluctuate. Trying to time the market can lead to missed opportunities. Staying consistent, even in turbulent times, allows your investments to rebound and grow over the years.

Get in touch: we’re here to help

Compounding is like planting a tree: it takes time to grow, but the longer it stands, the bigger and stronger it gets.

Not quite sure how to start? You don’t have to go it alone. Working with an experienced Invest Link adviser can help you tailor your investment strategy to your financial goals, risk tolerance, and timeframe, ensuring you’re on the right path.

Disclaimer: The information provided in this article is intended for general informational purposes only and does not constitute financial advice. Every individual’s financial situation is unique, and financial decisions should be made based on your specific circumstances and goals. We recommend consulting with a qualified financial adviser before making any investment, insurance, or mortgage-related decisions. Mortgage Link, Insurance Link, Invest Link, and FG Link are part of the Link Financial Group, offering tailored advice and services to help you achieve your financial goals.