Three investment myths debunked

Many people think investing is only for the wealthy, the experts, or those who can handle big risks. Are any of these beliefs holding you back from growing your wealth?

Let’s debunk some common investment myths and see why starting your investment journey might be easier than you think.

Myth 1: You need a lot of money to start investing

Contrary to popular belief, you don’t need thousands of dollars to start investing. In fact, small, regular contributions can be surprisingly effective, especially when you start early.

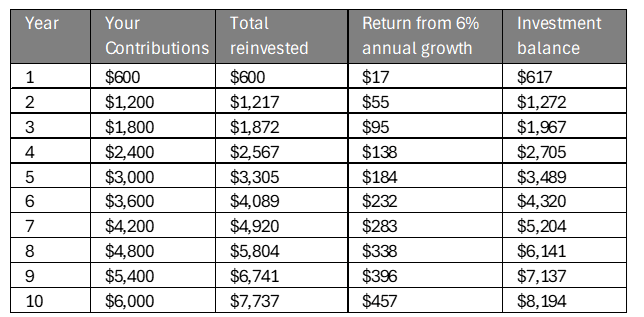

That’s thanks to compound growth: your returns are reinvested to generate even more returns, helping your investment grow significantly over time. Here’s an example to show how compounding works:

Let’s say you invest $50 each month ($600 a year) with an average annual return of 6%. After 10 years, your investment could grow to around $8,194, even though you would have only contributed $6,000.

Here’s a year-by-year breakdown.

This is the power of consistency. Starting small doesn’t mean compromising on growth. Even modest amounts, invested regularly, can lead to sound returns. So, don’t let the myth of needing lots of money keep you from getting started.

Myth 2: Investing is too risky

A fear of losing money often keeps people from investing. Yes, markets can be unpredictable and experience ups and downs, but not all investments carry the same level of risk. In fact, understanding how to manage risk is one of the core principles of investing.

One effective way to manage risk is through a well-diversified portfolio. By spreading your money across various assets—like shares, bonds, and property— and across sectors and geographies you’re not relying on the performance of a single investment. Different assets react differently to market changes. For example, while stocks may drop during a market downturn, bonds often hold their value or even increase. By balancing your portfolio, you can cushion the impact of any one asset’s poor performance.

Also, if you’re investing for long-term goals like retirement, focusing on the big picture can help you ride out short-term fluctuations. Over time, markets tend to recover and grow, so taking a long-term view can help ease worries about day-to-day ups and downs. With a well-thought-out strategy, investing doesn’t have to be about big risks—it can be about steady growth and financial security.

Myth 3: Investing is only for experts

Some people assume investing is too complex or that only experts can succeed. But this isn’t true—today, investing is more accessible than ever, with resources and expert support readily available to anyone. KiwiSaver is a perfect example, we have hundreds of KiwiSaver clients who have come to understand the benefits of regular contributions, compounding, and investing in a well-diversified portfolio.

Getting started with investing is about setting clear goals, understanding what you are investing in and how to manage the risk, and finding the right support. Working with an Invest Link adviser can simplify the process, providing clear guidance and a personalised plan. We can help you understand where your money is going and how to keep your portfolio on track as your life changes.

Ready to start? Get in touch

At Invest Link, we’re here to support you every step of the way. Whether your goal is to build wealth for the future or take control of your finances, we’re ready to help you create a plan that works for you.

Investing isn’t just for the wealthy or the experts—it’s for anyone ready to take small steps toward financial security.

Disclaimer: The information provided in this article is intended for general informational purposes only and does not constitute financial advice. Every individual’s financial situation is unique, and financial decisions should be made based on your specific circumstances and goals. We recommend consulting with a qualified financial adviser before making any investment, insurance, or mortgage-related decisions. Mortgage Link, Insurance Link, Invest Link, and FG Link are part of the Link Financial Group, offering tailored advice and services to help you achieve your financial goals.