How to make your KiwiSaver work harder for you

Is your KiwiSaver account working hard enough for you? Many people set it up and forget about it – assuming their contributions will take care of themselves. But if you’d like to make the most of this long-term investment tool, a few simple tweaks can go a long way.

Step 1: Choose the right fund type for your goals

KiwiSaver funds are not one-size-fits-all. The fund type you choose should align with your financial goals and investment horizon (or timeframe).

Generally speaking, funds differ based on their level of (likely) short-term risk and (potential) long-term returns. Growth funds, for example, offer comparatively higher risk in exchange for potentially higher returns, which can make them more appropriate for investors whose timeframe is longer than 10 years.

Balanced funds, on the other hand, offer moderate growth with less volatility, while conservative funds (low risk, lower expected returns) may be a better option if you plan to withdraw your KiwiSaver funds in the next few years (for a first home or for retirement).

Defensive funds offer security if you plan to withdraw your KiwiSaver funds in the short-term, for example if you are in the process of looking for, or buying, your first home (at this point you really don’t want any volatility).

Remember, as your goals and timeframe change, reviewing your fund selection regularly is crucial. Your Invest Link adviser can help you find the right match.

Step 2: Check your contribution rate

The more you contribute to your KiwiSaver savings, the bigger your retirement nest egg will likely be. But are you contributing enough to meet your future financial needs?

KiwiSaver allows you to contribute 3%, 4%, 6%, 8% or 10% of your salary. Many people assume that contributing the minimum 3% of their salary will be enough for a comfortable retirement, but that’s not always the case. To ensure financial security in later years, it’s important to run your numbers and plan ahead.

As a general rule of thumb, you may need to replace around 70-80% of your pre-retirement income until at least age 90 (or even longer, depending on your circumstances). One way to determine whether you’re on track is to use a KiwiSaver calculator—this will help you estimate how much you need to contribute now to build the retirement income you want.

Even better, talk to one of our financial advisers who will help you make sense of the numbers. KiwiSaver calculators are broad brush, but we are all different and will have different circumstances and goals during retirement.

Step 3: Maximise annual Government contributions

Have you ever heard of the annual Government contribution? Essentially, for every dollar you contribute to your KiwiSaver savings in the year between 1 July and 30 June, the Government contributes an extra 50 cents to your account – up to a maximum of $521.43 per year. Every KiwiSaver member aged 18 to 65 is eligible.

In other words, to get the maximum annual Government contribution this year, you need to contribute at least $1,042.86 (about $20 per week) in the 12 months leading up to the next 30 June. Employers contributions don’t count.

So, what if you’re not on track? You can still top up your account before the deadline (or at least by mid-June to give your KiwiSaver provider time to process your transaction). If you are uncertain, talk to a financial adviser or contact your KiwiSaver provider.

Step 4: Understand how performance affects your balance

Our analysis indicates that the most important factor is for you to be in the correct type of fund – this is more important than the particular provider you choose, their performance, or fees. We believe that you are better off being in the correct type of fund with an average provider, rather than the incorrect type of fund with best performing provider.

That said, we have agreements with a number of very capable KiwiSaver providers who have very good track records for performance, customer satisfaction, and ethical investing. Of course, past performance is no guarantee of future performance, so we continue to monitor our KiwiSaver providers and their capabilities.

Do fees matter, yes, but so do performance, quality of service and investment practices. So, when we look at the performance of our KiwiSaver providers, we look at performance after fees. This is standard industry practice.

Step 5: Keep a long-term perspective

One of the most common mistakes KiwiSaver members make is reacting emotionally and switching funds during market downturns.

Remember: markets will always go up and down, and short-term drops are normal. KiwiSaver is designed for the long haul and, given time, markets tend to recover. In other words, time in the market beats timing the market – long-term investors who stick with their plans and stay invested tend to see better returns.

Not quite sure? Get in touch before making any changes. We’re here to help you keep a calm head. Please do not make any rash decisions without discussing with a financial adviser. One of our advisers would be happy to discuss your KiwiSaver with you, without charge.

Step 6: Check your tax rate (PIR rate)

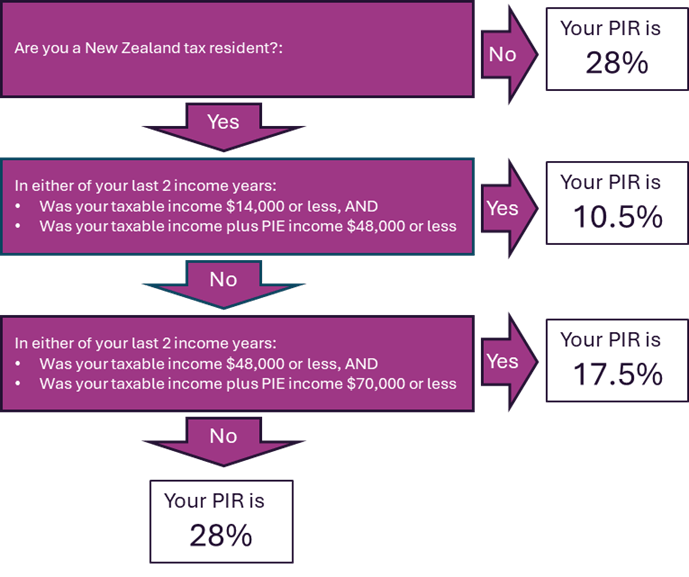

This is the rate at which your KiwiSaver is taxed – 10.5%, 17.5% or 28%. One of the advantages of KiwiSaver Schemes is that they are a type of Portfolio Investment Entity (PIE) meaning that the maximum tax rate is 28%. A Portfolio Investment Entity is a type of managed fund that invests in different kinds of passive investment, like KiwiSaver. The default rate is also 28%.

To calculate the rate that applies to you, work out your income for each of the last two years and use the flow chart below.

Step 7: Check in regularly

KiwiSaver is designed to be a long-term investment, but that doesn’t mean you should ignore it completely. It’s a good idea to set a KiwiSaver check-in reminder and book a review meeting with us once a year, to stay on top of your investments.

Need help optimising your KiwiSaver?

Get in touch. Your Invest Link adviser is here to provide expert guidance every step of the way, including checking your contributions, fund type and fees.

Disclaimer: The information provided in this article is intended for general informational purposes only and does not constitute financial advice. Every individual’s financial situation is unique, and financial decisions should be made based on your specific circumstances and goals. We recommend consulting with a qualified financial adviser before making any investment, insurance, or mortgage-related decisions. Mortgage Link, Insurance Link, Invest Link, and FG Link are part of the Link Financial Group, offering tailored advice and services to help you achieve your financial goals.