Paying too much tax on your KiwiSaver? Check your PIR

When it comes to growing your KiwiSaver or any other investment in a Portfolio Investment Entity (PIE), checking that you’re on the right Prescribed Investor Rate (or PIR) can make a big difference.

From 1 April 2025, the PIR income thresholds have changed. So, now’s a great time to check your settings and make sure you’re not paying more tax than you need to, or risking a bill from Inland Revenue later.

Why your PIR matters

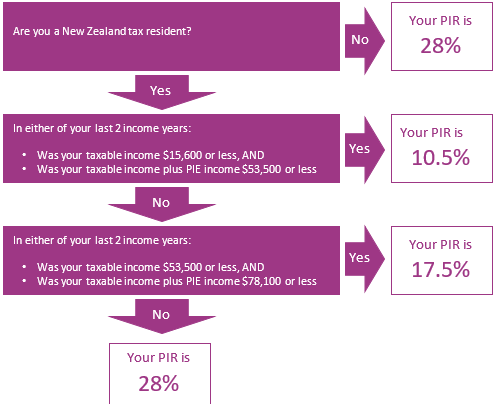

Your PIR is the tax rate used to calculate how much tax you pay on income from PIE investments like KiwiSaver. Based on your total income, including income from salary or wages and investment returns, this could be 10.5%, 17.5% or 28%.

If your PIR is too high, you could be overpaying tax on your KiwiSaver savings – leaving less money invested for growth. If it’s too low, you might be underpaying tax, which could result in a surprise tax bill.

And it happens more often than you think: a 2019 report indicated that approximately 1.5 million Kiwis were on the wrong PIR, with 950,000 overpaying tax and 550,000 underpaying it.

What’s changed from 1 April 2025

The Government has updated the income thresholds that determine your PIR. Here’s a visual breakdown of the new thresholds:

For example, if you earned $50,000 in salary and $2,000 in KiwiSaver returns, your total income is $52,000. That puts you in the 17.5% PIR bracket. In other words, if you’re set at 28% PIR, you’re likely overpaying.

How to check if you’re on the right PIR

Checking only takes a few minutes and it might save you hundreds of dollars. Here’s how:

- Work out your PIR

Use the infographic above or the simple PIR Checker on the IRD website.

- Check what rate you’re on now

Log in to your KiwiSaver provider’s portal or your myIR account to see your current PIR.

- Update your PIR

If your PIR needs changing, you can update it through your KiwiSaver provider’s portal or app, or directly via myIR.

As always, if you have any questions, we’re here to help. You can call us on 0800 466 784 or email admin@investlink.co.nz.

Disclaimer: The information provided in this article is intended for general informational purposes only and does not constitute financial advice. Every individual’s financial situation is unique, and financial decisions should be made based on your specific circumstances and goals. We recommend consulting with a qualified financial adviser before making any investment, insurance, or mortgage-related decisions. Mortgage Link, Insurance Link, Invest Link, and FG Link are part of the Link Financial Group, offering tailored advice and services to help you achieve your financial goals.