The power of time for an investor

As an investor, one of the most powerful tools in your toolbox isn’t how much you earn or how well you ‘time’ the market (which is not a wise investing strategy).

It’s time itself.

Starting early – even with small, regular contributions – can make a big difference to your financial future. This is called compound growth. Let me explain: One of the best ways to visualise compounding is a snowball rolling down a hill. At first, it’s small and slow – but as it rolls, it gathers more snow, grows and picks up speed. By the time it reaches the bottom, it’s a lot bigger than when it started.

Investing works in a similar way. When you reinvest your returns, your money starts earning money on top of money. And over time, that effect accelerates exponentially.

In short: even small, regular contributions can ‘snowball’ into something substantial, if you give them enough time.

Real-life example: Starting at 25 vs 35

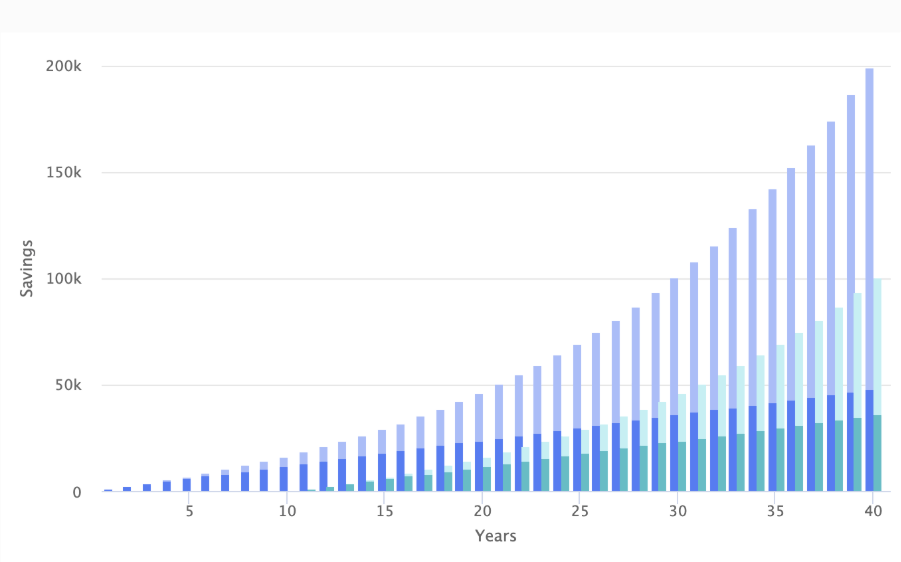

Let’s say you invest $100 a month into a diversified fund with an average annual return of 6%, compounding monthly*. Your goal is to boost your retirement nest egg and access it at age 65.

- If you start at 25:

You invest $100/month for 40 years.

Total contributions: $48,000.

Potential balance at 65: ~$200,000. - If you start at 35:

You invest $100/month for 30 years.

Total contributions: $36,000.

Potential balance at 65: ~$100,000.

The difference? $100,000 – all thanks to getting in early Here’s a chart to help you visualise it: in blue, someone starting to invest at 25, in green someone starting at 35. The darker shades represent deposits made, while the lighter shades show the growth from interest over time.

*Calculations and graph via MoneySmart.gov.au Compound Interest Calculator.

Waiting costs more

In other words, starting early means you can invest less and still end up with more. The longer you wait, the more you’ll need to contribute to reach the same goals.

For example, to accumulate $200,000 in your retirement funds by age 65:

- Starting at 35, you might need to invest $100/month.

- Starting at 35, you’d need to invest about $200/month.

- Starting at 45, you’d need to invest more than $400/month.

It’s not just about retirement

Starting early isn’t just for retirement planning. Investing can help you work towards all kinds of long-term goals: a first home, a sabbatical, helping your kids with tertiary education costs, or building a safety net for the unexpected.

Whatever your goals are, time gives your money more room to grow.

You don’t need to do it alone

When it comes to investing, the best time to start was yesterday. The second-best time? Today.

If you’re unsure where to start, how much to invest and where, talking to an Invest Link adviser can help. We’ll help you define your goals, understand your risk tolerance, and put a plan in place that fits your lifestyle and budget.

Disclaimer: The information provided in this article is intended for general informational purposes only and does not constitute financial advice. Every individual’s financial situation is unique, and financial decisions should be made based on your specific circumstances and goals. We recommend consulting with a qualified financial adviser before making any investment, insurance, or mortgage-related decisions. Mortgage Link, Insurance Link, Invest Link, and FG Link are part of the Link Financial Group, offering tailored advice and services to help you achieve your financial goals.