Renting in retirement? Here’s how to plan for it

We often hear that owning a home is the key to a secure retirement. But what if homeownership just hasn’t worked out – or isn’t likely to? Can you still retire with confidence?

Yes, it’s still possible. It just takes a bit of extra planning and a fresh perspective. And the best time to start is now.

Here’s what you need to know.

Why you need a solid plan

For many New Zealanders, homeownership has long doubled as a retirement strategy. The idea is simple: by the time you stop working, your mortgage is gone, and your home provides rent-free living or becomes a source of equity if you decide to downsize.

But if you’re still renting when you retire, it’s important to have a plan that factors in:

- Ongoing accommodation costs (including potentially rising rents)

- Less flexibility to reduce your living costs later

- No property to sell or borrow against if needed.

And while NZ Super may provide a foundation, data shows that it’s often not enough to cover all living costs. That doesn’t mean retiring as a renter is off the table. But it does mean your savings will likely need to grow faster and stretch further.

How much will you need?

As we explained in our article “How much will you need to retire comfortably?”, a good rule of thumb is to aim for a retirement income that replaces 70 to 100% of your current take-home pay.

- If you’ll own your home mortgage-free, 70-80% may be enough to cover your needs (keeping in mind costs like Council rates, insurance and maintenance).

- If you expect to rent, or want more lifestyle flexibility, 90-100% may be a more accurate target.

For example:

If you currently take home $1,200 per week, you might aim for a retirement income of $1,000 – $1,200 per week, or $52,000 – $62,000 per year.

Keep in mind, this goal will likely need to increase over time to keep up with inflation, especially if you’re still years or decades away from retiring.

If you can’t tap into property, what else can you do?

Owning a home and downsizing is one way to fund your retirement, but it’s not the only way. Here are other levers you can pull:

- KiwiSaver

Your KiwiSaver settings can make a big difference to your retirement savings. Make sure you review your contribution rate and check you’re in the right fund for your risk profile and timeframe.

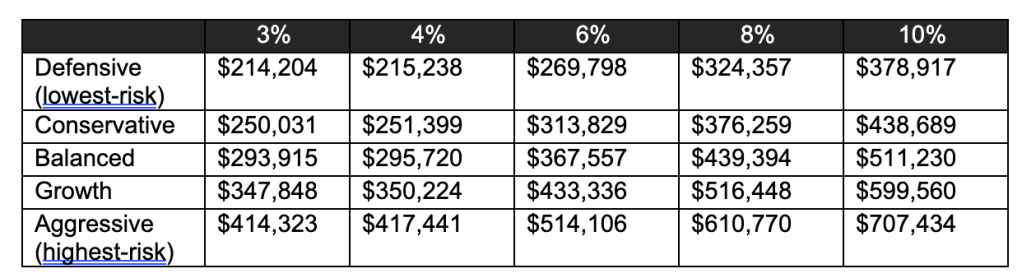

For illustration purposes, meet Kate:

- 35 years old

- Employed, earning $80,000/year

- Has $50,000 in her KiwiSaver account

- Her employer contributes 3%.

Here’s how much Kate could save by age 65, depending on her fund type and personal contribution rate.

Source: Sorted’s KiwiSaver calculator

As you can see, both your fund type and your contribution rate can affect your retirement savings outcome. The earlier you adjust these settings, the more time you give compounding to work in your favour.

- Diversified investments

Beyond KiwiSaver, a well-diversified investment portfolio can help you grow your nest egg while managing risk. Shares, managed funds, bonds and index funds can all play a part.

Not sure where to start? An Invest Link adviser can walk you through your options and help you build an investment strategy that matches your goals.

- Working longer (if it suits you)

Depending on your circumstances and health, working part-time past 65 might be a practical way to stretch your retirement funds further. For some, it’s also a way to stay active, connected and engaged with the world.

Even a small weekly income in your 60s or 70s could reduce pressure on your savings.

Are you sure you can’t buy?

Before locking in a renter’s retirement plan, it’s worth pausing to ask: Are you sure that buying a home is off the table?

Sometimes, options exist that you may not have considered yet – from co-ownership and tiny homes to alternative lending strategies. A Mortgage Link adviser can help you explore what’s realistic and whether buying might still be part of your long-term future.

We‘re here to help

You may not need a house to build a secure retirement. But you probably do need a plan.

Let’s talk about what your future could look like, and how we can help you get there.

Disclaimer: The information provided in this article is intended for general informational purposes only and does not constitute financial advice. Every individual’s financial situation is unique, and financial decisions should be made based on your specific circumstances and goals. We recommend consulting with a qualified financial adviser before making any investment, insurance, or mortgage-related decisions.