What will retirement cost you?

Retirement is not a destination, but a journey in itself.

It’s a lifestyle that could stretch across 20, 30 or even 40 years. And according to the latest Retirement Expenditure Guidelines from Massey University, NZ Super alone is unlikely to cover it.

So, how much should you be aiming to save? Let’s take a closer look.

The pension gap

For many eligible Kiwis aged 65-plus, NZ Super provides a valuable income base. But just like previous years, the 2025 Guidelines confirmed there’s a clear shortfall between what Super provides and what most retirees actually spend.

Source: New Zealand Retirement Expenditure Guidelines as at 30th June 2025

For example:

- Couples living in cities need on average around $1,780 per week to maintain a comfortable retirement lifestyle. That’s over $950 more than what NZ Super offers.

- Single retirees in provincial areas spend between $580 (no frills) and $771 (choices) per week – more than their NZ Super entitlement ($538.42/week).

The message is clear: most Kiwis need additional income or savings to close that gap, and that takes planning. The earlier you start, the better.

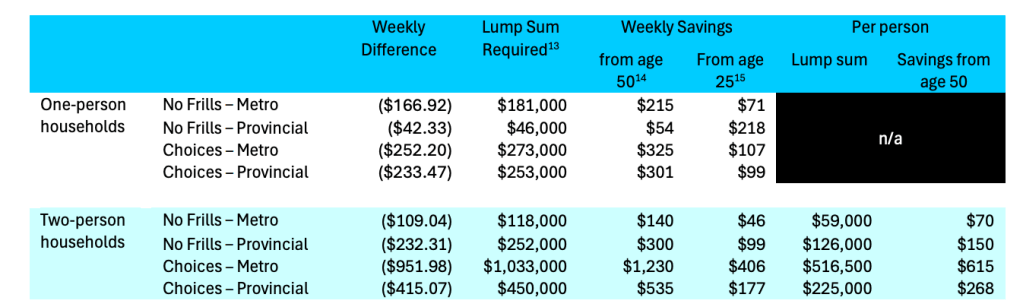

What does it take to bridge the gap?

The Guidelines also estimate how much retirees need in lump sum savings to supplement NZ Super. As the table below shows, numbers vary widely depending on the household type, location and lifestyle of choice.

Source: New Zealand Retirement Expenditure Guidelines as at 30th June 2025

These figures offer a starting point for your own retirement plan, but every situation is different. Make sure you run your own numbers to understand if you’re on track.

Here’s a guide to help you with that.

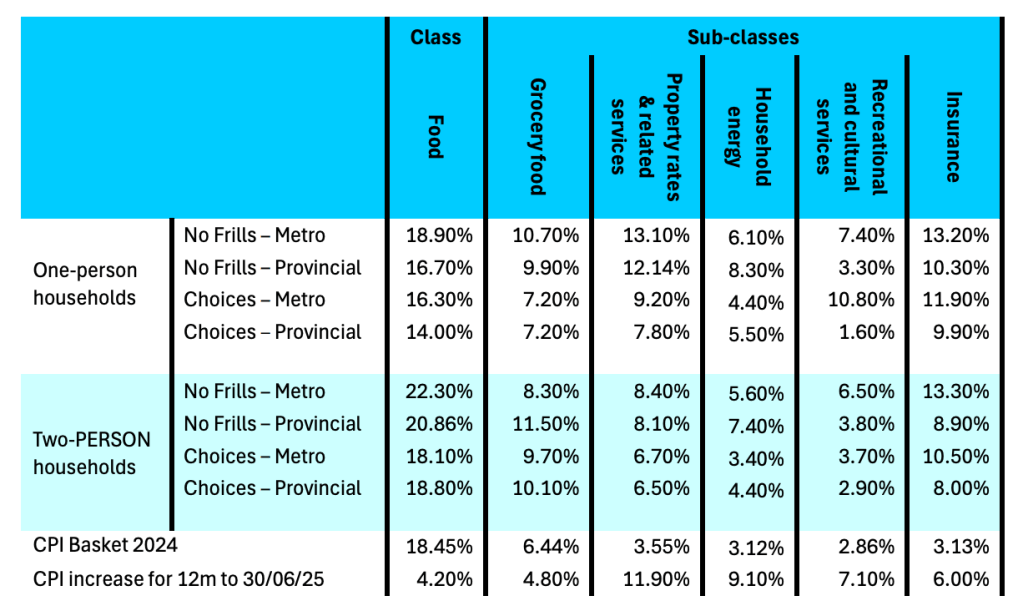

What’s driving the costs?

Although overall inflation has cooled since 2024, key living costs for retirees continue to rise.

In the year to June 2025, the cost of housing (with rates, insurance and maintenance costs increasing), renting, healthcare, utilities and energy bills rose between 4.2% and 11.9% – all faster than the official inflation rate.

Source: New Zealand Retirement Expenditure Guidelines as at 30th June 2025

What future retirees should know

This data highlights a growing need for a solid plan.

Today’s retirees are more likely to own their home. But for future generations, things could look quite different. Some big-picture trends to consider include:

- Declining home ownership rates – Renting in retirement is increasingly common, which brings higher ongoing costs and less financial certainty. We wrote a guide about that too.

- Longer life expectancies – Retiring at 65 could mean funding another 25+ years of living expenses.

- NZ Super as we know it may change – That brings us to the next big question…

Will NZ Super still be around?

It’s a question that economists, politicians and everyday Kiwis continue to debate.

Some argue changes are inevitable, due to rising life expectancy and falling birth rates. NZ Super is funded by current taxpayers, and in the coming decades, there’ll be fewer workers supporting more retirees. That’s a tough equation to balance.

Potential changes could include a higher eligibility age and some form of means testing (common in other countries).

What does this mean for your retirement plan?

If you’re close to retirement – say, within 10-15 years – it’s unlikely that NZ Super will change much.

But if retirement is still decades away, consider treating NZ Super as a bonus rather than a given. The goal is to build up your own savings and investments, so you’re not overly reliant on any one income source.

Not sure where to start?

Your Invest Link adviser can help you make sense of the numbers and build a practical plan that fits your goals.

Whether you’re five or fifteen years away from retiring, there’s no better time to start shaping the future you want.

Disclaimer: The information provided in this article is intended for general informational purposes only and does not constitute financial advice. Every individual’s financial situation is unique, and financial decisions should be made based on your specific circumstances and goals. We recommend consulting with a qualified financial adviser before making any investment, insurance, or mortgage-related decisions.

Please visit important-information-about-us-invest-link.pdf for more and disclosure information